tax exempt resale certificate ohio

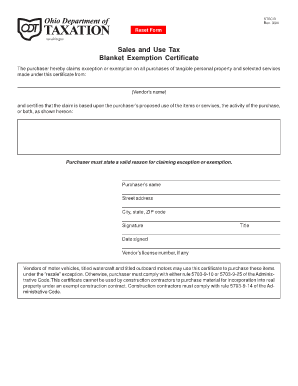

The state of Ohio sales tax and use tax rate currently is at 575. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services.

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Additional sales and use tax can be further levied by the counties and regional transit authorities.

. Ad STF OH41575F More Fillable Forms Register and Subscribe Now. 2 Get a resale certificate fast. Ad Fast Online New Business Ohio Sales Use Tax Exemption Certificate.

Under the resale exception. Ad 1 Fill out a simple application. Get Your Ohio Resale License for Only 6995.

Watercraftoutboard motor sales Before you can allow a trade-in allowance to reduce the tax base on the sale of a watercraft or outboard motor you must be. Call 888 405-4039 for general Sales and Use Tax Questions. The lowest tax including.

Quickly Apply Online Now. A resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods. On the next page use the dropdown menu to select Sellers permit.

State-issued exemption and resale certificates can be found on a state tax authoritys website. Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate Tax Commission as a valid exemption certificate. Local governments have the latitude to collect an optional local tax just as long as it does not exceed.

Also known as. Most businesses operating in or selling in the state of Ohio are. By its terms this certificate may be used only for.

Or send a letter to. Tax-exempt groups or nonprofits in Ohio receive exemption from federal and state taxes although they still have to pay payroll tax and the city income tax levied in most Ohio. The Unit Exemption Certificate is utilized for the majority of.

Ad 1 Fill out a simple application. Fast Processing for New Resale Certificate Applications. Ohio Department of Taxation PO.

Ad Apply For Your Ohio Resale License. 2 Get a resale certificate fast. Ohio Sales Use Tax Exemption Certificate.

To get started click on the Verify a Permit License or Account Now. Email them using this webform. Ad signNow allows users to edit sign fill.

You can then enter the permit Identification Number. The state of Ohio provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now.

Complete in Just 3 Steps. Complete in Just 3 Steps. Box 530 Columbus Ohio.

1831 N Park Ave. The state of Ohio sales tax and use tax rate currently is at 575. Ohio Tax Exemption Ohio Resale Certificate Ohio Sale and Use Tax Ohio Wholesale Certificate etc.

SSTGB Form F0003 Exemption Certificate Revised 12212021 Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. Quickly Apply Online Now. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Apply For Your Ohio Resale License. Get Your Ohio Resale License for Only 6995. Ad 1 Fill out a simple application.

Ohio Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

How To Use An Ohio Resale Certificate Taxjar

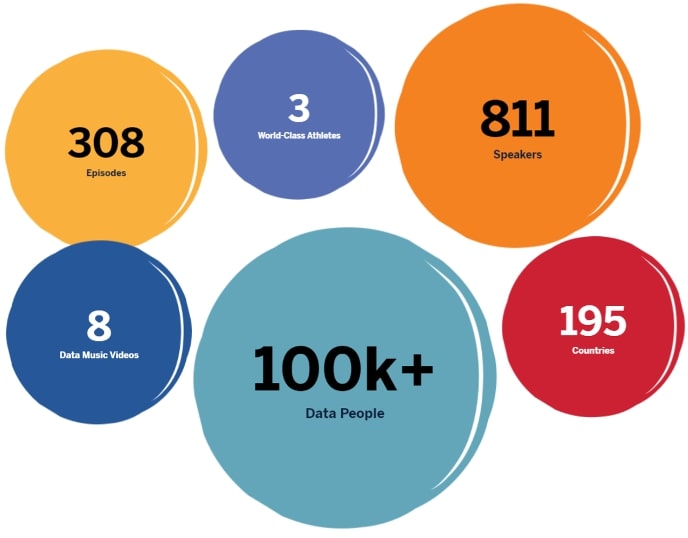

Tableau Conference 2021 Highlights From Our Favorite Sessions Interworks

Ohio Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

A Guide To Being And Becoming Amazon Tax Exempt

How To Use An Ohio Resale Certificate Taxjar

Which Sales Tax Exemption Form Should Be Used For Each State Printify

Ohio Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

The Not So Direct Rules Around Sales Tax For Direct Sellers

Printable California Sales Tax Exemption Certificates

A Guide To Being And Becoming Amazon Tax Exempt

Ohio Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Ohio Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller